The oil and gas prices surge in the post-COVID recovery period and, more substantially, due to Russia's invasion of Ukraine, gave the perception that oil firms are unfairly profiting from high energy prices, or even worse, from war and bloodshed.

Backed by this considerable political momentum, the governments of Italy, Spain, the UK and Romania have introduced new taxes on the high profits of the energy industry, so-called "windfall profit taxes", or windfall taxes. Tax authorities and lawmakers argued that the additional tax revenues would fund the reduction of energy prices and finance support packages for low-income households. In March, the European Commission stated support of tax measures on windfall profits, approved by the EU Parliament in July. Similarly, in the US, growing numbers of lawmakers are calling for windfall taxes on energy companies.

In common language, windfall profits are "excessive profits", or economic gains due to luck, rather than effort or other productive activities.

Ironically, the term windfall arose from a practice that likely involved nothing akin to unearned gains: "windfall, as a term for an unexpected piece of good fortune, goes back to medieval England, when commoners were forbidden to chop down trees for fuel. However, the debris was a lucky and legitimate find if a strong wind broke off branches or blew down trees." Windfall was the recovery by the poor of low-value property abandoned by the rich.

Windfall taxes appear to be fair and easy to enact; however, economists have thoroughly and long discredited them.

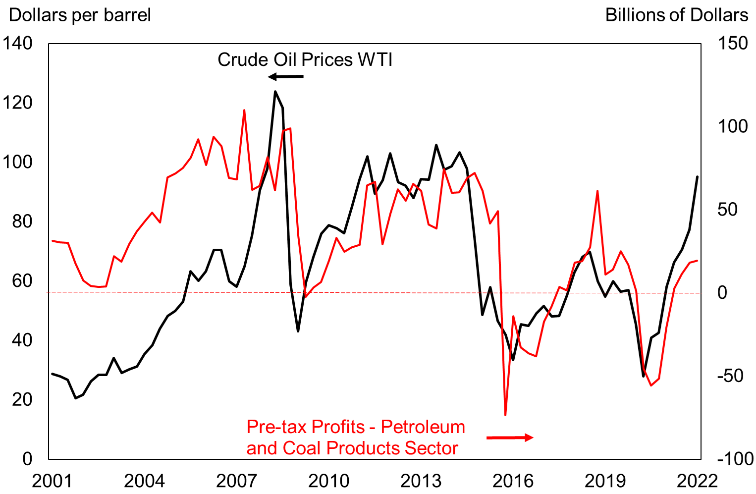

First, windfall profit taxes are inefficient and arbitrary. Energy industry profits are affected by numerous factors but tend to rise with rising oil prices and tend to fall with falling energy prices. Chart 1 plots the quarterly average WTI crude oil prices against the pre-tax profits of the petroleum and coal product manufacturing sector in the US over the last twenty years. The chart shows the co-movement of energy industry profits with oil prices over time.

Importantly, the energy sector experienced losses during periods of relatively low oil prices (i.e. in 2015, 2016 and 2020), so oil companies suffering a one-off windfall tax now might call for a one-off subsidy if oil prices collapse. In addition, the tax (be it an income tax or an excise tax) requires the determination of the excessive profits, effectively meaning that the tax authorities would arbitrarily determine the level of normal profits in each country. Crucially, profits and rates of return which deviate from the averages are both a common and essential aspect of modern market economies, as observed by Shapiro and Pham (2005). Innovative firms typically generate these abnormal profits. It is a fantasy to think that the necessary investment would happen if these uncommon profits were subject to windfall taxes rather than standard tax liability.

Second, windfall taxes distort economic decisions and markets. Energy companies know that oil prices are subject to long-term increases and decreases due to market conditions and political events. Therefore, it will finance the lean years with the boom years. Their investment decisions are based on long-term planning, and, in a sense, higher profits in boom years are like a deferred return, although not fully anticipated or quantifiable. A windfall tax will eventually slow investments in the energy sector, ultimately resulting in a smaller energy-producing industry. The argument is reinforced by the - rather technical - observation that the higher uncertainty created by one-off taxes makes firms more cautious in their investment and employment response, resulting in sub-optimal investment and hiring plans.

An additional unwelcome consequence of the windfall tax would be an increasing dependence of the country levying the tax on oil and energy imports from other countries.

Third, windfall taxes result in losses for shareholders and savers. As the windfall tax reduces the corporate earnings of energy companies and consequently their share price based on their price-earnings ratio and their dividend payouts, the tax would result in foregone gains for shareholders, savers and pension funds invested in these companies.

Finally, from a constitutional law perspective, introducing a new form of sector-specific taxation would lead to unequal treatment of taxpayers that would need to be justified by a valid reason to be in line with general constitutional law principles.

As the energy prices surge has created many winners and losers, windfall oil taxes appear to be an efficient instrument for financing support packages targeted at low-income households by levying a tax on excessive profits of energy companies.

Imposing windfall taxes is a mistake when all the economic costs - inefficiency, the arbitrariness of the tax base, distortions of economic decisions and shareholders' losses - are duly taken into account.