Individuals and families are increasingly responsible for their own savings and investment decisions. We will enjoy longer lives and life expectancies are expected to increase. At the same time, the standard of living provided by a given amount of income is likely to fall over time due to inflation, as prices of goods and services more commonly increase rather than decrease. Hence, we need to supplement public and private retirement benefits with additional savings. Retirement readiness requires an intelligent management of money over our lifetimes - saving during our working years and then drawing down assets when we retire, as predicted by the life-cycle model.

Financing retirement is a daunting task, and the burden is on us. Crucially, the decision to work part-time results in lower savings for financing consumption in retirement. This pension penalty should be included in the decision of achieving a better work-life balance overall the full life cycle. The well-being of our older self deserves consideration. Financing consumption in retirement has to include the provisioning for the eighth and even for the ninth decade of our lives, when we decide on the optimal balance between work and leisure during our working years.

Failing to include our older self in the decision of how much to work today will result in some unpleasant consequences: not enough income to cover expenses during retirement, work part-time during retirement or postpone retirement.

Plenty of life

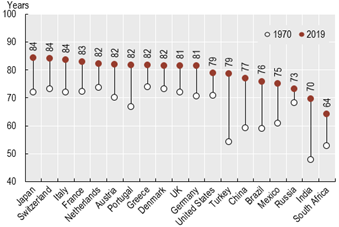

It is not exaggerating to say that rising life expectancies around the world are one of the most extraordinary achievements of the twentieth century. Chart 1 shows that a Swiss citizen born in 1970 had a life expectancy of 73 years and, fifty years later, a newborn in Switzerland is projected to have a life expectancy of 84 years. Across the OECD club of developed economies, the gains were about as large and across emerging economies the gains were even larger between 1970 and 2019.

Chart 1: Life expectancy at birth, 1970 and 2019 (or nearest year).

Source: OECD Health Statistics 2021.

This welcome demographic development means more people need to pay for more years of living after retirement.

An aging population is a challenge for governments - the recent protests in France against Mr. Macron's decision to increase the pension age from 62 to 64 years illustrate the political costs of reforming pension systems -, for employers setting up pension funds for their employees and for households and families deciding how much to save (and work) for their retirements.

For J. Poterba, "only economists could turn the prospect of someone managing to live a very long time into something that is potentially problematic". Fortunately, economists also produce calculations that estimate how much individuals should save in order to achieve certain life goals or certain levels of retirement income, provided the estimates are viewed with some caution.

Live long and … prosper?

Retirement planning requires answering many hard questions including expectations on longevity, health status, capital market returns and amount of saving. The answers are not obvious as these factors are surrounded by considerable uncertainty and depend on personal and subjective circumstances.

Within this context, together with Dr. Marcus Wunsch and Dr. Arun Muralidhar, we are developing a conceptual framework to Goals-Based Investing (GBI) and investment products to support individuals to achieve their retirement goals.

GBI is a new investment paradigm that can be applied to the retirement problem as it aligns savings and investing guidance by seeking to achieve financial goals at certain future points in time. Compared to the traditional portfolio optimization paradigm, GBI focuses on the individuals' retirement income goals. One of the innovative ideas that we plan to implement is the inclusion of the investors’ risk appetites regarding return volatility and wealth drawdowns into the GBI paradigm in order to create viable investment solutions for retirement investing.

This approach can be adapted for controlling the relative drawdown of a portfolio strategy versus a passive benchmark by ongoing adjustments that recalibrate the individual’s strategy based on life or market events. This is a powerful concept from an investment perspective. In fact, personalization can better align the asset allocation strategy to take more investment risk to close a retirement savings gap and less investment risk if the individual is on track or projected to meet their goal.

Retirement planning starts earlier than 30 and ends beyond 65.

Francesco Mandalà, PhD

PS "Ciao older me, I hope you are in good health, though you are frail, vulnerable and gray. Hope you are still loved by your family and friends. You are not a bore, are you? I imagine you are playing tennis and skiing in the time left from reading and learning, right? I have high expectations in you, as I worked hard and full time for your work-life balance. Sincerely, Younger Me"