Israel's remarkable economic performance continued in 2022, a new government coalition led by Mr. Netanyahu took power last December and the country marked its 75th anniversary in April. Yet, instead of celebrations, Israel faces a crisis.

On 24 July, the Israeli Parliament (Knesset) passed a bill that strips Israel's Supreme Court of the power to declare government decisions "unreasonable", weakening the independence of the judiciary and its power to constraint the government's actions. The bill triggered social confrontation and mass protests, joined also by Air Force reservists and by the tech industry workforce.

At the core of the clash between government and the population is the fact that Israel has no codified Constitution. As the country has a single chamber parliament, in which the government commands a majority, the Israeli Supreme Court is the only institution that can check and balance executive decisions. Because of Israel's peculiar institutional setting, the judicial reform is a constitutional reform, and large parts of the Israeli society demand that the passage of this reform be supported by a wide consensus, not just by the current majority in the Knesset.

The crucial economic question is how the conflict between government and society triggered by the constitutional reform might affect the long-term economic growth of Israel.

Remarkable economic performance so far

Israel's GDP increased 6.5 percent in 2022, with growth mainly driven by the high-tech sector, which represents about 17 percent of GDP and more than half of the country's total exports. Public finances are healthy with a debt-to-GDP ratio around 60 percent; the unemployment rate is at 5.4 percent; the inflation at about 4.0 percent is above the target range and decelerating. The Israeli economy has been thriving over the last five years, as it outperformed the OECD countries with a more modest contraction and a stronger recovery from the Covid recession.

Growing rich or getting poorer?

The well-established tradition of economic growth theory has identified innovation, economies of scale, education and capital accumulation as the key factors explaining why some countries are much richer. Economists have also argued that culture and values are potential determinants of long-term economic growth; the Bank of Israel has developed a model that incorporates the main religious groups - Jews, Orthodox Jews and Arabs - as input for forecasting the aggregate human capital in Israel.

D. North and R. Thomas, who pioneered new institutional economics, believe that these explanations fall short. They claim that institutions, which they define as the rules of the game in a society, are the fundamental explanation of economic growth. The question why some nations are poorer than others is closely related to the question of why some nations have "worse institutions" than other nations. This is a powerful idea.

Within this framework, D. Acemoglu and J. Robinson document that countries that have “inclusive” governments - those extending political and property rights broadly, enforcing laws and providing public goods - experience the highest level of growth over the long run. On the other hand, Acemoglu and Robinson affirm that countries with “extractive” political systems - in which power is concentrated in the hands of a small elite with little constraints and checks on the politicians - either fail to grow broadly or collapse after short bursts of economic expansion.

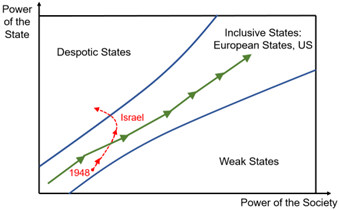

Central to this approach is the idea that institutions are determined by the conflictual interaction between "society", which wants liberty but cannot sustain order, and "state", which maintains order but grows oppressive. Depending on other conditions such as geography and social structures, the theory leads to three distinct configurations for the polity (Chart 1): despotic states, inclusive states and weak states.

Chart 1: Emergence and dynamics of various types of states.

Source: MBaer evaluation based on Acemoglu-Robinson model

In the "inclusive states", the powers of the society and of the state are balanced, leading to prosperity and to the highest level of growth. In both the "despotic states" - in which society is powerless and the state is strong and oppressive - and the "weak states" - in which the state is non-existent creating a constant threat to property and to life - the countries fail to grow broadly or collapse after short bursts of economic expansion.

The deep conclusion of the institutional hypothesis is that good institutions, the inclusive states, are the result of the balance of power between state and society. Such a balance is difficult to achieve and to maintain but the reward is high long-term growth.

Israel has solid economic fundamentals, sizable fiscal buffers and proven record of good macroeconomic management, which historically supported its remarkable economic performance. In absence of a written Constitution, the Israeli judicial reform weakens the independence of the judiciary and its power to constrain government's actions. The reform could potentially move Israel closer to the group of nations with relatively strong states and relatively weak societies (see Chart 1), which are usually unable to achieve high levels of long-term growth.

Francesco Mandalà, PhD