Up, Up, Hooray! Irrational exuberance has gone viral

Tech stocks' hyperbolical rise, markets' new heights and cryptocurrencies manias are currently top of mind for investors.

Obviously, investors are interested in getting rich quickly when markets are soaring and preserve their wealth when markets are dropping. If people tend to buy assets when prices increase or to sell assets when prices decrease, these reactions may result into more prices' changes in the same direction causing a continuation of the up- or the down-ward market cycle.

The crucial question is whether we are currently riding a bubble, a market situation where asset prices are supported only by expectations of further price increases, and whether eventually this bubble will burst.

The alternative interpretation is that major asset classes are reasonably priced, as they reflect ideal macroeconomic conditions, supported by the current monetary and fiscal stimulus measures.

We believe that investors' irrational exuberance is driving the recent market dynamics and we should expect a market correction in response to this speculative euphoria.

The Fed Chairman Alan Greenspan first used the phrase "irrational exuberance" in 1996 as he commented on high stock prices in Japan (on the same day Tokyo closed at -3%). He was referring to the mindset that prevails among investors just ahead of a market crash, such as the one in the 1990s.

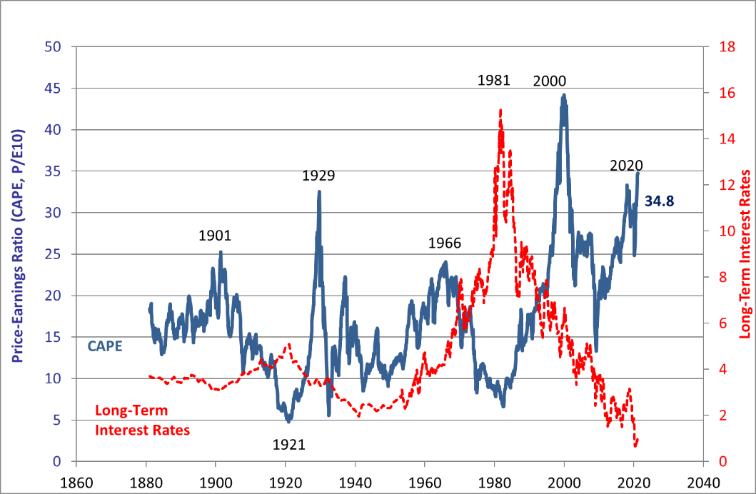

Nobel-awarded economist Robert Shiller, a scholar of market bubbles, compiles the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, used as a long-term valuation measure of the S&P 500 index. The CAPE ratio is simple: it divides share prices by the average of corporate profits over ten years, to even out the fluctuations of the cycle. The recent market rally has taken the CAPE value to 34.8, above its level in 1929 and second only to the levels registered in the early 2000s, and both periods were followed by market crashes (see Chart 1).

Chart 1: CAPE ratio and long-term interest rates

Source: R. Shiller "US Stock Markets 1871-Present and CAPE Ratio"

Predicting when a bubble bursts is nearly impossible, but the CAPE is telling us that markets are expensive and we should certainly expect lower returns and higher market volatility in the months ahead.

Chart 1 also plots the US long-term-interest rates, currently at their historically low levels, suggesting that bonds are also overpriced, perhaps even more expensive than stocks. Based on bonds' extreme valuations, some investors argue that the equity rally is set to continue, as equities should outperform bonds, at least as long as rates will remain low.

What are the options for investors holding the traditional 60/40 portfolio, invested 60% in equities and 40% in bonds? Investors benefitted from the 60/40 portfolio for decades, in light of the good performance of the two asset classes.

The strength of this portfolio relies on portfolio diversification, i.e. the property that high quality bonds tend to move inversely to equities, acting as a hedge when equity markets drop. At the current level of yields, this property may no longer work because there is limited space for bond yields to move lower, in case of a sharp market correction.

One possible solution is further diversifying away from bonds and equities by adding other asset classes, such as commodities, alternative investments or bitcoins to the portfolio.

Last year, however, showed that room for manoeuvre is limited by looking at the co-movements of various asset classes, computed by NYU Prof. Aswath Damodaran.

In 2020, equities moved together across markets and regions, and so did corporate bonds, commodity prices and real estate, which moved strongly with equities. Treasury bond prices moved inversely with stock prices but gold and silver provided partial hedges against stocks and bonds.

Bitcoins had a spectacular performance last year behaving more as risky equities rather than an hedging asset.

Cryptocurrencies are wildly volatile currencies with limited and expensive use for transactions. Their prices do not reflect any intrinsic market value, as they are not an asset nor a commodity but just a speculative currency.

Perhaps the emblem of markets' euphoric rides, bitcoin reached the USD 50'000 mark in February this year, vindicating its early investors and reinforcing the charismatic role of the "messiahs of momentum" (a term coined by J. Zweig on the WSJ), a list of Wall Street outsiders including Tesla's founder Elon Musk.

Despite a plethora of modern economic and statistical investigations, we cannot know whether we are in a bubble and if it will eventually burst. Equity markets may continue rising fuelled by cheap money, abundant liquidity and investors' euphoria.

Our concern is the accumulation of evidence about markets' overvaluation and investors' irrational exuberance, which will result in a market correction regardless of any central banks' intervention.

We prefer defensive and under-valued equities and we recommend our clients to take profits from selected tech and growth stocks. We maintain our gold exposure and keep on investing in low-cost instruments and active managers for selected asset classes in our mandates.

Francesco Mandalà, PhD

March 1, 2021

Disclaimer

This document is for information purposes only. It constitutes neither an offer nor a recommendation to purchase, hold or sell financial instruments or banking services, and does not release the recipient from carrying out their own assessment. The recipient is recommended in particular to check the information in terms of its compatibility with their own circumstances and its legal, regulatory, tax and other consequences, possibly on the advice of a consultant. The data and information contained in this publication were prepared by MBaer Merchant Bank AG with the utmost care. However, MBaer Merchant Bank AG does not assume any liability for the correctness, completeness, reliability or topicality, or any liability for losses resulting from the use of this information. This document may not be reproduced in whole or in part without the written permission of MBaer Merchant Bank AG.

Dieses Dokument dient ausschliesslich Informationszwecken. Es stellt weder ein Angebot, noch eine Empfehlung zum Erwerb, Halten oder Verkauf von Finanzinstrumenten oder Bankdienstleistungen dar und entbindet den Empfänger nicht von seiner eigenen Beurteilung. Insbesondere ist dem Empfänger empfohlen, allenfalls unter Beizug eines Beraters, die Informationen in Bezug auf die Vereinbarkeit mit seinen eigenen Verhältnissen, auf juristische, regulatorische, steuerliche, u.a. Konsequenzen zu prüfen. Die in der vorliegenden Publikation enthaltenen Daten und Informationen wurden von der MBaer Merchant Bank AG unter grösster Sorgfalt zusammengestellt. Die MBaer Merchant Bank AG übernimmt jedoch keine Gewähr für deren Korrektheit, Vollständigkeit, Zuverlässigkeit und Aktualität und keine Haftung für Verluste, die aus der Verwendung dieser Informationen entstehen. Dieses Dokument darf weder ganz oder teilweise, ohne die schriftliche Genehmigung der MBaer Merchant Bank AG reproduziert werden.