A spectre is haunting Europe...

... the spectre of poor economic growth

An old joke about economists goes like this: "How has French revolution affected world economic growth? And the economist answers: It is too early to say."

More seriously, one of the most important questions in economics is why the standard of living in some countries increases more than in other countries, or: why some countries are better at growing than others?

Ideas make material progress possible [1]

Modern macroeconomic theory suggests that technologies created by inventors, engineers and scientists and organized by entrepreneurs generate long-term growth. Therefore, the argument goes, the US economy grows better than other industrial countries due to its entrepreneurial culture, to a financial system that supports entrepreneurial activities and to lighter labor regulations, especially compared to Europe. Olivier Blanchard, former chief economist at the IMF, used the term Eurosclerosis for describing the structurally higher unemployment rate of Europe as compared to the US: European labor market institutions - unemployment benefits, minimum wages and so on - are simply not well adapted to the high level of technological changes of modern economies. Hence, labor market institutions have been hardening the economic structure of the region, resulting in lower growth and higher unemployment than the US.

This is only a part, in fact the long-term bit, of the story.

European and American responses to the pandemic

Last year, the hit from the pandemic in Europe has been worse than in the US, as measured by the GDP fall at -6.6% for the euro area and at -3.5% for the US. Both the Fed and the ECB launched some of the largest stimulus plans in history, reducing interest rates (Fed) and turning to additional bond-buying programs and lending operations (both ECB and Fed).

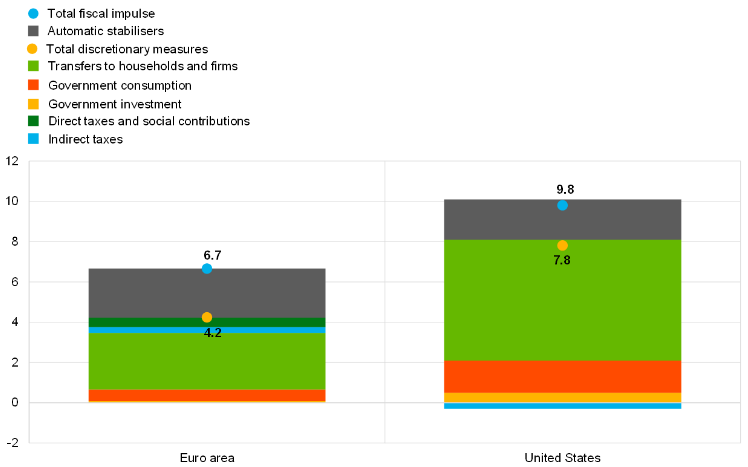

In addition, the fiscal policy response was substantial in both the euro area and the US, although stronger in the US, at 10% of GDP, than in the euro area, at 7% of GDP (see Fig. 1).

Importantly, the EU and the US policy-makers made different employment choices, as the EU decided to focus on protecting employment through job-retention schemes and maintain public service jobs, whereas American state and local governments laid off 1.3m employees.

In addition to the 2020 policy decisions, the EU’s new Recovery Fund will result in a further EUR 750bn in spending beginning this year, although it pales compared to Biden administration's spending plans at some USD 1.9trn.

The European recovery plans are especially large for Italy and Spain (12% of GDP) and Greece (19% of GDP) and focus on public investments rather than on current spending, which is taken as good news for boosting sustainable growth. The question is rather on the timing of the disbursement of the Recovery Fund, expected to be at 1% of the Eurozone GDP this year, which will limit its effectiveness during the next months, as the economies are gradually reopening.

Fiscal response to pandemic in the euro area and the US

(% point contributions to changes in the primary budget balance-to-GDP ratio)

Atlas shrugged

Obviously, neither the US administration nor the EU government bodies are omnipotent. Moreover, even under the optimistic scenario that the generous fiscal packages on both sides of the Atlantic would be smoothly and timely implemented, their long-term impact comes with unpleasant side effects. First, trying to achieve too high a level of output will lead to increasing inflation, especially in the US, where the Fed has repeatedly clarified its tolerance for a level of inflation higher than its 2% target. Second, more importantly, the huge budget deficits will lead to an accumulation of public debt; but high public debt/GDP levels are harmful for economic growth, as the historical experience of highly indebted countries has shown. The southern European countries may be especially subject to this adverse implication, given their already high levels of public debt, which may eventually lower the European growth prospects.

It might be too early to assess the impact of the French revolution on global growth, but we can say that Europe is falling behind the US as the US has put its past behind it and focuses on the future, while Europe is wallowing in self-pity and history.

Francesco Mandalà, PhD

Chief Investment Officer

Footnote

[1] Paul Romer Nobel Lecture 2018: On the Possibility of Growth

Disclaimer

This document is for information purposes only. It constitutes neither an offer nor a recommendation to purchase, hold or sell financial instruments or banking services, and does not release the recipient from carrying out their own assessment. The recipient is recommended in particular to check the information in terms of its compatibility with their own circumstances and its legal, regulatory, tax and other consequences, possibly on the advice of a consultant. The data and information contained in this publication were prepared by MBaer Merchant Bank AG with the utmost care. However, MBaer Merchant Bank AG does not assume any liability for the correctness, completeness, reliability or topicality, or any liability for losses resulting from the use of this information. This document may not be reproduced in whole or in part without the written permission of MBaer Merchant Bank AG.

Dieses Dokument dient ausschliesslich Informationszwecken. Es stellt weder ein Angebot, noch eine Empfehlung zum Erwerb, Halten oder Verkauf von Finanzinstrumenten oder Bankdienstleistungen dar und entbindet den Empfänger nicht von seiner eigenen Beurteilung. Insbesondere ist dem Empfänger empfohlen, allenfalls unter Beizug eines Beraters, die Informationen in Bezug auf die Vereinbarkeit mit seinen eigenen Verhältnissen, auf juristische, regulatorische, steuerliche, u.a. Konsequenzen zu prüfen. Die in der vorliegenden Publikation enthaltenen Daten und Informationen wurden von der MBaer Merchant Bank AG unter grösster Sorgfalt zusammengestellt. Die MBaer Merchant Bank AG übernimmt jedoch keine Gewähr für deren Korrektheit, Vollständigkeit, Zuverlässigkeit und Aktualität und keine Haftung für Verluste, die aus der Verwendung dieser Informationen entstehen. Dieses Dokument darf weder ganz oder teilweise, ohne die schriftliche Genehmigung der MBaer Merchant Bank AG reproduziert werden.